In today’s fast-paced digital landscape, content creation has become a cornerstone of success for businesses […]

Email Marketing In The New Era: Trends And Techniques For Success

Struggling to keep up with the rapid changes in email marketing? You’re not alone. With […]

FM WhatsApp APK Download Latest V8 35 (Anti-Ban) – Update 2023

You must have heard about FM WhatsApp at some point or other. So today we are going […]

How to Check Compatibility Testing in Different Browsers?

Web apps have become the backbone of our online experiences in today’s digitally-driven society. However, […]

Top 5 Plumbing Business Software Solutions in 2023: The Latest Review

To deliver great customer service and exceed the competition, running an effective plumbing business demands […]

The Best Tools For Optimal Space Management Solutions

Space management solutions provide companies with a convenient, user-friendly solution to efficiently understand and control […]

Top 10 Mobile App Development Companies in London

An accurate and continuous connection with your customers is essential for any business to grow. […]

GB Instagram Latest Version Download APK: The Ultimate Instagram Experience

GB Instagram Latest Version Download APK Instagram has taken the world by storm and has […]

Technicolor Horizons: Painting Futures with Innovation

In a world where innovation is the driving force behind progress, the canvas of our […]

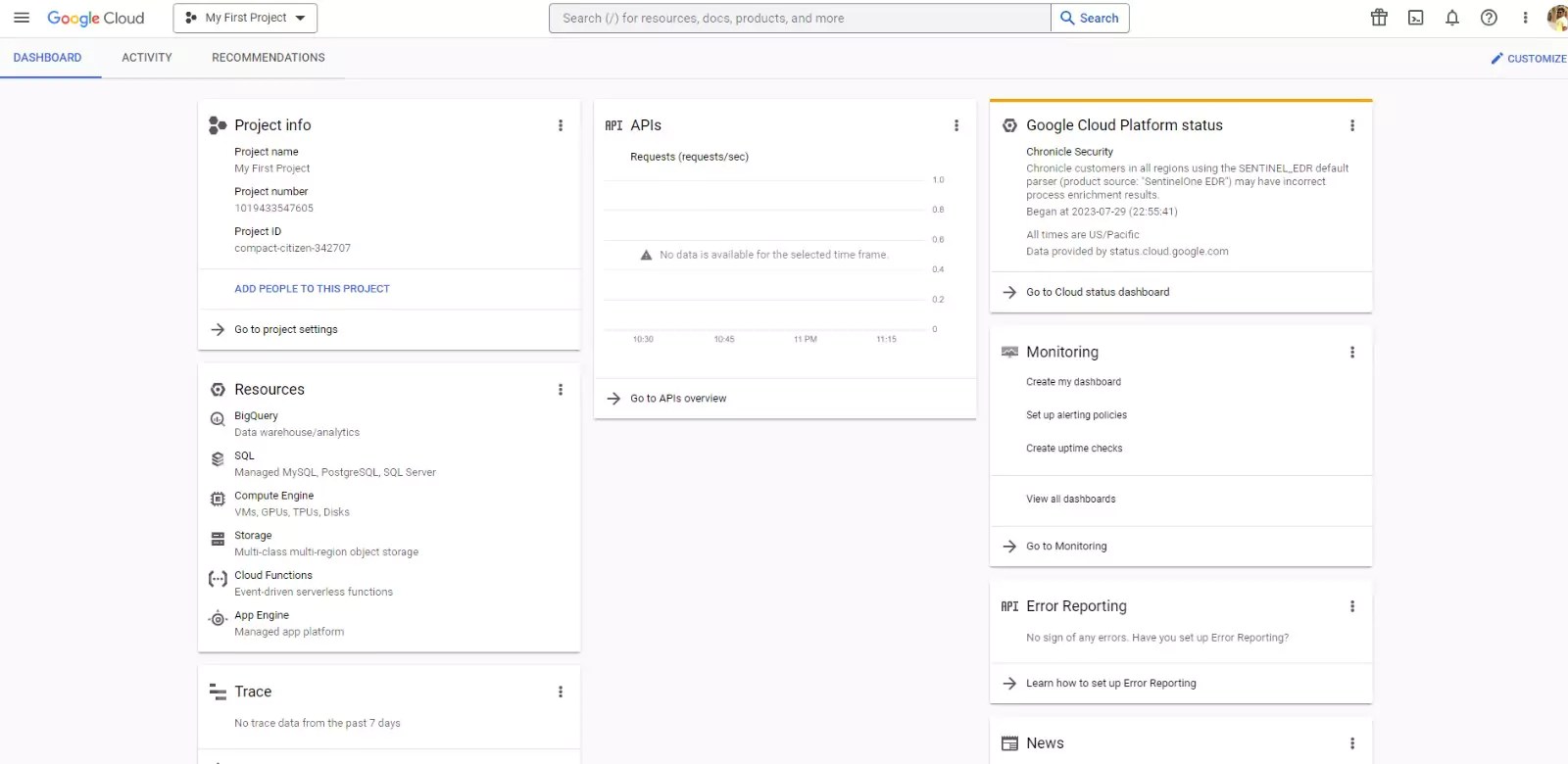

Navigating the Google Cloud Platform Console Like a Pro!

In today’s fast-paced technological landscape, cloud computing has become an integral part of businesses, offering […]